Bed And Isa Transaction

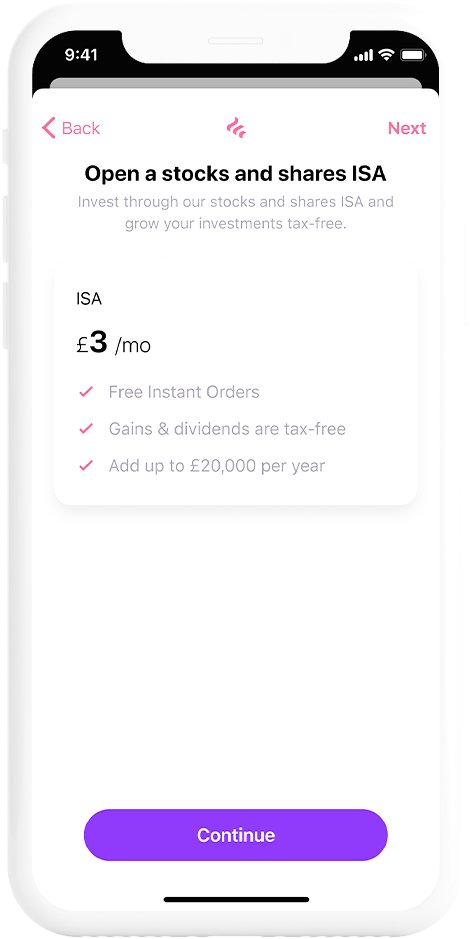

BED and ISA Open or top up an ISA with existing investments.

Bed and isa transaction. We provide you with a comprehensive range of reporting tools and online functionality. This of course means a bed ISA is only available for stocks. The tax-free saving plan that.

A bed and ISA is a double transaction that can help shelter your non-ISA investments from capital gains tax and further tax on dividends First you sell your chosen non-ISA investments the bed half of the phrase and then use the proceeds to buy them back immediately within an ISA without having to wait for the settlement of funds. Now I completely understand that all FUTURE sales and dividend payouts for the shares in the ISA are free of CGT. Many investors adopt this Bed and ISA approach at the end of the tax year disposing of their current investments and reinvesting in the new tax year once their ISA allowance has been renewed.

The topics of measurement include. There are no transaction fees on a Bed and ISA transaction but there may be CGT charged on the sale of the investments and Stamp Duty and the Panel of Takeovers and Mergers levy will apply to purchases where applicable. Now to bed and ISA.

Same as above but this time on 20th January 2021 the 100 shares are purchased for 120 per share WITHIN AN ISA WRAPPER. CG13350 - Bed and breakfasting. Shares held within an ISA are generally free of both income tax and CGT.

I declare that Signature Date Please use this checklist to ensure that you have enclosed all the documents required for us to complete the Bed ISA transaction. The proceeds of the sale once settled are then subscribed to the ISA account as part of the yearly ISA allowance of 2000000. Such a delay could mean that we cannot complete your Bed ISA instruction for the current tax year.

It refers to a pair of transactions that investors use to move their portfolio into a stocks and shares ISA - thats an individual savings account for anyone unfamiliar with the acronym. It sounds like a contradiction in terms. Bed and ISASIPP Move investments to an ISA or SIPP Important information - Investments can go down as well as up in value so you could get back less than you put in.