Bed And Breakfast Taxation

Book Bed Breakfast in Delhi.

Bed and breakfast taxation. This bed and breakfast procedure was frequently used at the end of the tax year by taxpayers who wished to. If the expense is incurred exclusively for the customer then it is generally deductible. Need to keep records of all income earned and declare it in your income tax return.

This means things like advertising direct food costs laundry service for the bedrooms car hire upkeep and maintenance of the rooms etc. 44000 Cabin or hut operation. 44000 Backpacker hostel operation.

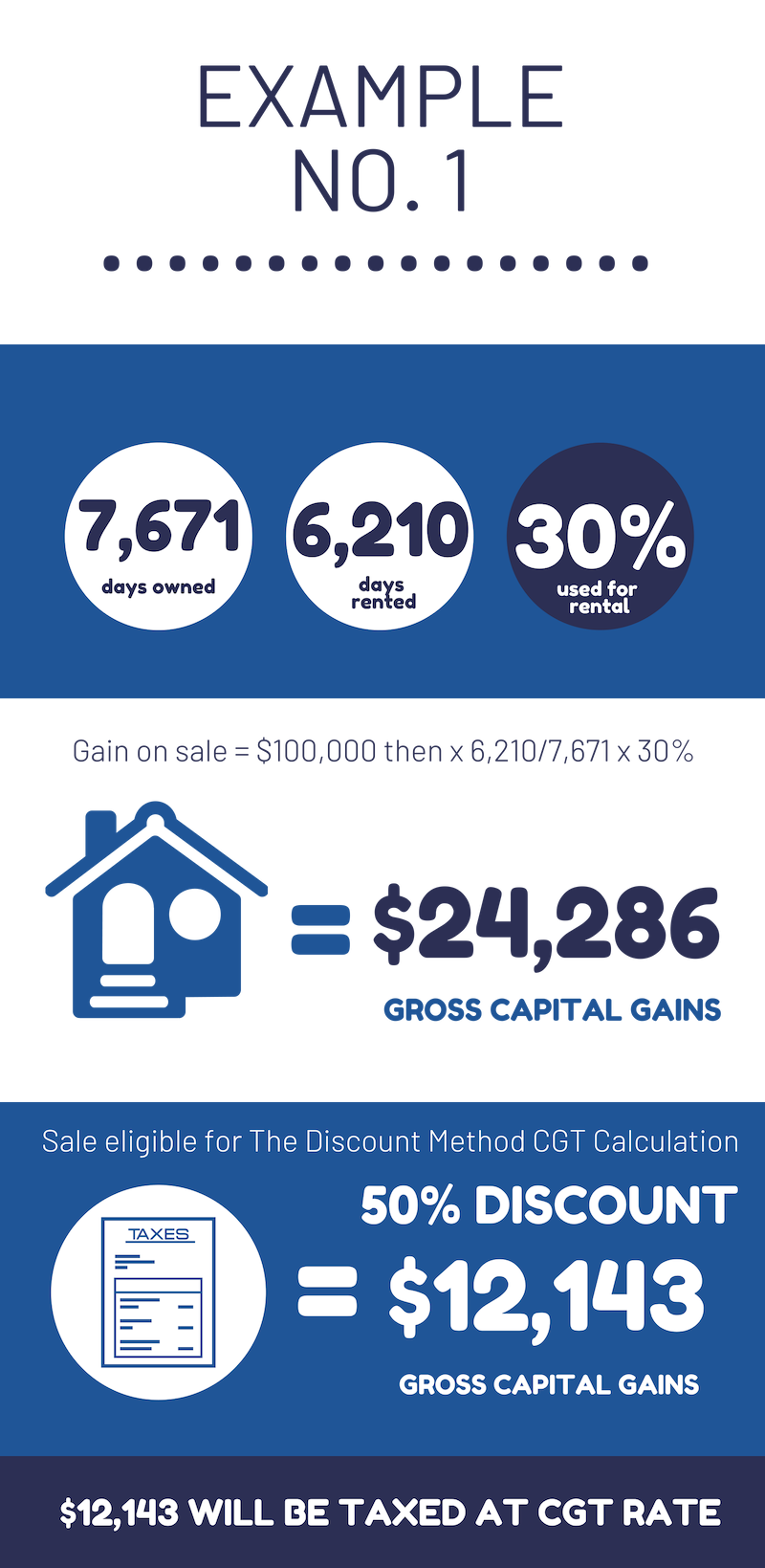

Current share matching rules. Renting out all or part of your home. Utilise their annual exemption for the tax year realise gains that could be covered by unused capital losses or realise losses and set them against gains for the year that was just ending.

For more information visit. Taxationjack and jill jointly own and run a bed and breakfast business the business is run through their partnership j j bed and breakfast jack and jill also own an investment property together whic. Ad Check hotel Photos Reviews Book Now Save up to 80.

Ad Lowest price guarantee. This rule makes tax loss harvesting slightly more difficult but still possible. NSW BB operations are ideally suited to meet this expectation.

Capital Gains Tax 30 Day Rule Bed and Breakfast. Book Bed Breakfast in Delhi. At Como Bed Breakfast youll be 42 km 26 mi from Perth Zoo and 69 km 43 mi from Crown Perth.